Baidu, Alibaba and Tencent's Roles in Chinese AI Development

This article is an excerpt from Silicon Road's 'China's AI Landscape Report' which you can now download for free here.

This article is an excerpt from Silicon Road's 'China's AI Landscape Report' which you can now download for free here.

China’s AI industry is made up of broad array of companies which specialise in different applications of the technology. The sector is led by large established technology companies, who capitalised on vast datasets on their existing user base allowing them to improve the accuracy of machine-learning models. They have also ensured their continued relevance in the field by investing heavily in emerging startups entrenching their position at the top of the ecosystem hierarchy.

Internet companies Baidu, Alibaba and Tencent (known by the collective acronym BAT) have become specially designated national champions for artificial intelligence technology. They have been able to develop a broad range of competencies across different AI sectors to compete against smaller, more focused incumbents.

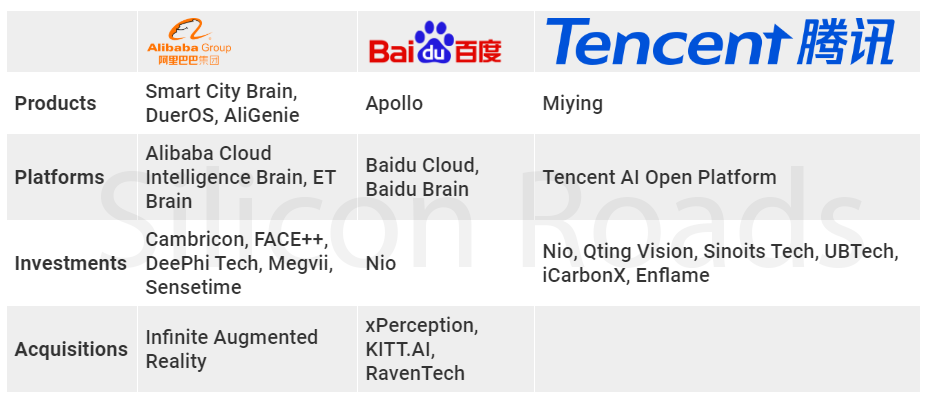

Key business areas, investments, and products for BAT (Baidu, Alibaba and Tencent)

Key business areas, investments, and products for BAT (Baidu, Alibaba and Tencent)

Baidu established an early focus on AI, establishing the Institute of Deep Learning in 2013 and mentioning the technology regularly on subsequent earnings calls. Tencent was later to invest, not announcing until Q1 of 2017 that it would pursue AI research. Despite this, Tencent has quickly established a presence in the sector through Tencent and Youtu Labs’ research focused on adopting machine-learning technologies in existing products and developing AI-powered diagnostic medical imaging service Miying.

As the developer of WeChat, (a hub for payments, messaging, and other applications) Tencent benefits from the ability to draw on an array of purchasing, communication, and behavioural data from over one billion users. It has also invested in a significant proportion of China’s emerging AI unicorns (private companies valued at more than $1 billion). Tencent’s approach to investments sees it rarely investing more than 20% in startups (except in the gaming sector) so has not made any significant acquisitions. In contrast, Baidu has acquired numerous US-based AI startups including U.S. computer vision firm xPerception and chat-bot and voice-recognition company Kitt.ai in 2017. In total, Baidu has invested in AI companies across 11 different categories ranging from healthcare to AI chips.

While China’s established technology companies tend towards developing artificial intelligence solutions across multiple industries, they have also developed specialties in certain niches where they have the potential to become the clear market leader. One core focus for Alibaba is smart cities, and Alibaba Cloud’s City Brain initiative aims to create a platform to power the next generation of smart cities by aggregating and analysing data to improve urban efficiency. The project first saw the company partner with the city of Hangzhou to monitor and reduce traffic congestion and have recently expanded trials outside of China with a pilot in Malaysia. The company claims this has already helped to increase the average speed of traffic in Hangzhou by 11%. Baidu’s niche has been the self-driving space with the aim of the Apollo platform to become the ‘Android’ of self-driving cars. However, despite announcing an array of global partners, the only active participant in its ‘open ecosystem’ is Baidu, with other partners providing nominal assistance in an industry where companies have proven unwilling to share data.

While BAT are the leaders among established companies entering the AI-space, other large Chinese technology companies such as telecommunications provider Huawei and technology company Xiaomi are also investing in building comprehensive AI portfolios that allow them to integrate AI into their products. In 2019 Huawei’s rotating chairman Eric Xi outlined the company’s vision for a “full-stack, all-scenario AI portfolio”. This requires a significant commitment towards research and development, in Huawei’s case representing over 80,000 employees (45% of their workforce). Its offerings so far have included an AI chip for smartphones called Ascend released in 2019 with technology from Cambricon, a Chinese startup spun-out from the Chinese Academy of Sciences. Huawei has also released MindSpore which is a Deep Learning framework for the training of neural network models competing with established Western alternatives TensorFlow and Pytorch. Huawei’s comprehensive AI offerings led Hurun Report and intellectual property platform WTOIP.com to describe the company as “China’s most competitive intellectual property owner in artificial intelligence (AI)”. In a report released in 2019 assessing the capabilities of more than 500 Chinese AI companies, they ranked Huawei as the leader, followed by Tencent and Baidu.

Despite an early lead for Baidu in the AI space and numerous acquisitions, it is yet to gain significant traction with its most costly endeavour, the Apollo self-driving car system compared to international competitors. Tencent was a relatively late entrant, however, had made early investments across a broad range of smaller companies. Alibaba has rolled-out an expansive smart-city platform which from an initial trial in Hangzhou, has now been expanded across China.